DonorWise 4.1 is a significant new release. In many subtle ways, DonorWise 4.1 is a re-imagining of many core features. Here is are the highlights of what is new:

- Integration with QuickBooks Desktop and QuickBooks Online. Most ministries that use DonorWise as their donation management system use QuickBooks as their accounting system. When you connect DonorWise with QuickBooks, DonorWise can sync it's GL Account and GL Fund lists with QuickBooks. ("RCs" are now called "GL Funds" in DonorWise.) If you track funds (staff/project accounts) in QuickBooks as Classes or as Customers/Jobs, DonorWise 4.1 will work with this. After you approve a batch, you can post it to QuickBooks. This will create a journal entry to your "Undeposited Funds" account, properly crediting each fund with donation income and with journal entries for assessments, if you use this feature. Later, you can "Make Deposit" in QuickBooks, and select these posted batches as undeposited payments, so that your deposits line up with what was actually deposited into your bank account.

Here are the various options for integrating DonorWise with your accounting system (GL):

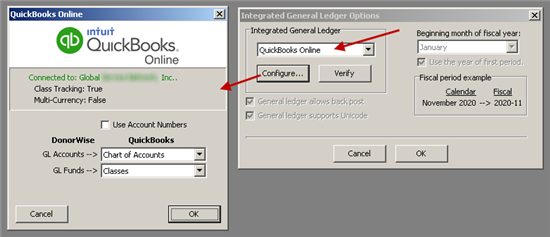

Here is what it looks like to setup an integration with QuickBooks Online:

Note: To integrate with QuickBooks Desktop, QuickBooks Online, Abila MIP or Dynamics SL, DonorWise needs to be connected to your DonorHub instance, and your DonorHub instance needs to be connected to your accounting system (for the "Account Report" option). If your DonorHub instance is connected to your accounting system, in the Control Panel on your Staff Portal, look for the "DonorWise Integration" control panel to setup the connection.

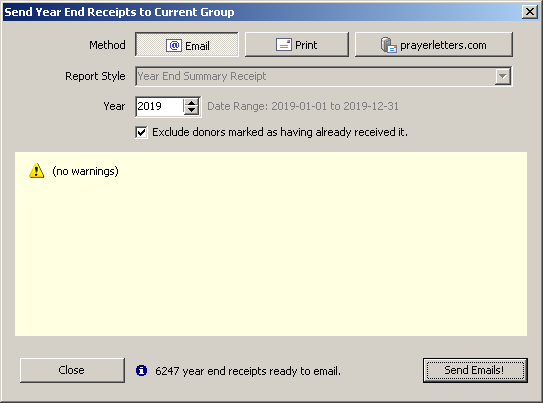

- Year End Receipts/Statements can now be printed or emailed, and DonorWise 4.1 tracks who receives which kind (paper or email) and helps you manage this process.

Here is the dialog for sending year-end receipts (via email, print or prayerletters.com):

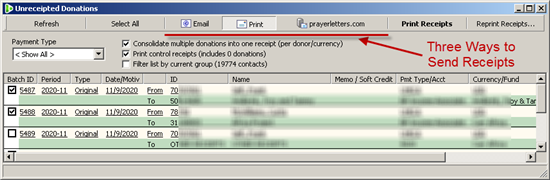

- DonorWise 4.1 can now directly outsource printing and mailing of receipts to prayerletters.com. This works for normal receipts as well as year-end receipts. If you're overwhelmed with sending out year-end receipts in January, DonorWise 4.1 can really help you here. First of all, you can email year-end receipts to all the donors for whom you have an email address. Then, for any remaining donors needing a year-end receipt, you can push a button to send a job to prayerletters.com, and then can print and mail them out for you. No longer do you need to print, fold, stuff and lick stamps!

This show the "Unreceipted Donations" screen, with the three methods for sending receipts:

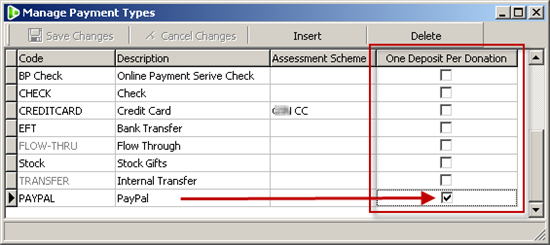

- Per-payment-type option to generate one deposit in QuickBooks per donation (instead of just one per entire batch). This comes in handy if you track your PayPal account in QuickBooks as a bank account. When you receive a donation via PayPal it shows up as a deposit in PayPal (minus fees). In DonorWise, you can create a single batch with multiple PayPal donations. When you post this batch to QuickBooks, you now have the option to have donations made under certain payment types (like "PAYPAL") to post each donation to QuickBooks as a separate payment. This way you can create a single deposit per donation and then add the fees (as you're making the deposit in QuickBooks), so the final deposit matches the deposit to your PayPal account exactly as it happened.

This shows the "Manage Payment Types" screen with this new option:

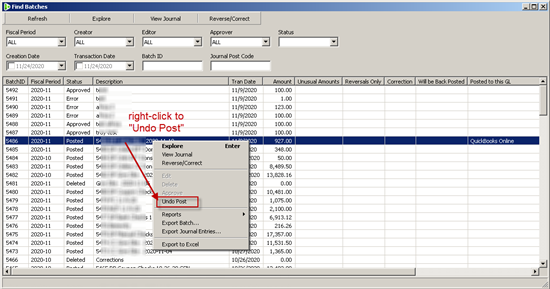

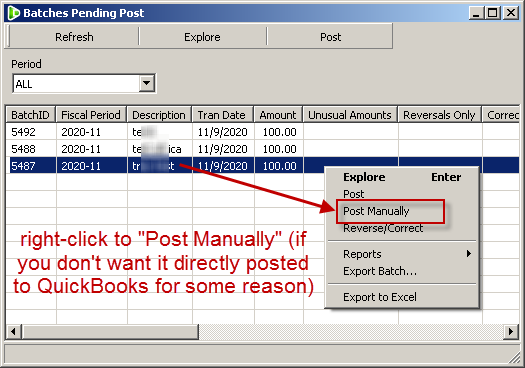

- More manual control over posting batches to your accounting system. If you want to repost a batch to your accounting system, you can right-click on a batch that is already posted (in the "Find Batches" screen) and "Undo Post". Then you can post it again. If this batch was previously posted to QuickBooks by DonorWise, DonorWise will offer to delete the batch from QuickBooks. Then you can post the batch again to your accounting system. If you'd prefer to post this batch manually to your accounting system (for whatever reason), you can right-click on the batch to "Post to GL Manually". You may never need these options, but when/if you do, you'll be glad to have this level of control.

This shows how you can right-click on a posted batch to "Undo Post" on the "Find Batches" screen:

This shows how you can right-click on an approved batch to "Post Manually" if you want to avoid having it posted directly to QuickBooks for some reason:

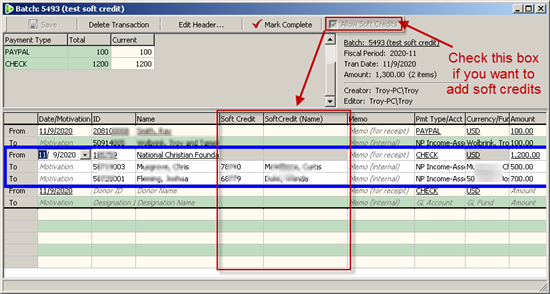

- On The Fly Soft Credits. DonorWise has had the ability to create "FLOW-THRU" batches for quite some time now. This is handy for when you receive a donation from a foundation or church, but you want to recognize the donor who gave thru the foundation or church. But there are some drawbacks to FLOW-THRU batches. For one, you have to create a separate batch for (often) that one donation in a pile of donations. Also, the legal donor (the foundation or church) doesn't get a receipt from DonorWise or might get skipped in some end-of-year reporting of which donors gave more than a certain amount in the previous year. Now, in DonorWise 4.1, as you're adding donations in to a new batch, you have the option to add the donation, and mention the "soft credit donor" (i.e. the donor who initiated the donation through a church or foundation). Either way (FLOW-THRU batch or indicating the donation's soft credit donor), the staff member can see the donation from the source donor on the Staff Portal in DonorHub, which is very helpful to the staff member! But, each approach has pros and cons. With Flow-Thru batches, DonorWise can send the source donor an acknowledgement, but the legal donor (foundation/church) receives nothing. With soft credits, the legal donor receives a receipt, but the source donor receives nothing (unless the staff member sends a thank-you through their use of TntConnect, and the notification they'd receive about the gift).

This shows you can add soft credit donors to a gift in the batch entry screen:

- Performance Improvements across the board, but especially with generating receipts.

- NOTE: Three Reports will be removed from DonorWise 4.1. These are related to analyzing assessments per responsibility center (now called GL Funds). If you have a need to report on assessment schemes per GL fund for a given date range, there are still ways to generate this information within DonorWise, but in general, it's recommended that you generate these reports form your accounting system. These are the three reports being removed in DonorWise 4.1:

- Donations and Assessments

- Assessment totals by scheme

- Assessment totals by receiving centre